Filing an Extension

Extension of Time to File

Any taxpayer may request an automatic extension of time to file their tax return with the IRS or a State tax authority. Extensions may be e-filed electronically, or a paper Form 4868 or Form 8868 (as appropriate) can be filed by mail. The taxpayer does not need to provide a reason why they are filing an Extension.

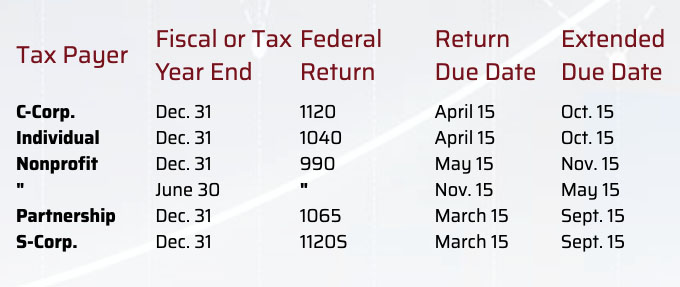

The filing of an Extension grants the taxpayer (up to) an additional 6 months to file their return. However, the filing of an Extension does NOT grant the taxpayer an extension of time to pay any additional income tax due. The schedule of extended due dates is as follows:

Tax Payer |

Fiscal or Tax |

Federal |

Return |

Extended |

| C-Corp. | Dec. 31 | 1120 | April 15 | Oct. 15 |

| Individual | Dec. 31 | 1040 | April 15 | Oct. 15 |

| Nonprofit | Dec. 31 | 990 | May 15 | Nov. 15 |

| " | June 30 | " | Nov. 15 | May 15 |

| Partnership | Dec. 31 | 1065 | March 15 | Sept. 15 |

| S-Corp. | Dec. 31 | 1120S | March 15 | Sept. 15 |

If the taxpayer owes additional income tax on their return for that year, the taxpayer should make an additional income tax payment with their Extension filing to cover any balance due.

If the taxpayer owes additional income tax for that year and does not make any additional income tax payment with their Extension filing, the IRS and State tax authorities have statutory authority to levy assessments for late payment and/or underpayment penalties, as well as interest, on the amounts overdue. Such assessments are calculated daily from the original due date of the return.

The filing of an Extension does NOT absolve the taxpayer from being assessed with late or underpayment penalties and/or interest charges levied by a taxing authority. To avoid such additional assessments, the taxpayer should make quarterly Estimated Tax Payments during the year, and/or an additional income tax payment with their Extension filing to cover any balance due.

More Topics

"Joe Twardy has helped us for several years to assure and certify our timely preparation of both Federal and state filings."

Barbara Hughey, Lexington, MA

"Hands down Joe Twardy is the best CPA I have worked with; I have and will continue to recommend him to everyone I know.K.D. Joslin"

K.D. Joslin

"Joe responded to the IRS, straightened out my errors, and made everything OK. From now on, my taxes will be done professionally."

B.J., Lexington, MA

Have a Question? Contact Us Today!

Sunapee: 603.763.0350

24 Pine Grove Rd., Sunapee, NH 03782

Lexington: 781.274.6600

405 Waltham St., Suite 382, Lexington, MA 02421